Last Updated on February 16, 2024

With another year closed, 2024 is stretched out before us like a blank canvas. For construction businesses, there is plenty of potential for growth and success, though they’ll likely be plagued with some of the same issues they’ve dealt with for years. Challenges like cost overruns, acquiring skilled staff, and knowing where your job costs are at have generally been expected in the last few years.

So what can the construction industry expect from 2024? Let’s take a look into what’s on the horizon in this 2024 construction outlook.

In this blog:

- What is the Construction Market Outlook for 2024?

- Is the Construction Industry Slowing Down?

- Planning for Labor Gaps and Shortages

- Strategizing for Unstable Prices and Costs

- Supply Chain and Material Availability

- How to Combat Economic Challenges in the Construction Market?

What is the Construction Market Outlook for 2024?

If there’s a word to describe the construction industry outlook in 2024, it would be cautiously optimistic. That’s not to say there aren’t challenges ahead in the construction forecast, the US and Canadian markets are poised for overall success—but for companies that can adapt and keep up.

Major Project Types

Some of the biggest focuses for the 2024 construction market will be manufacturing facility construction and infrastructure projects. Legislation money from the CHIPs Act continues to encourage tech manufacturers to build facilities in the US. Similarly, the IRA Act is injecting money into various infrastructure projects. While the legislation passed in 2021 and 2022, their impacts are expected to continue to provide fuel for the construction industry this year.

Sustainability is in the Spotlight

Sustainability will also be a major part of the construction outlook in 2024. With the International Energy Agency’s push for net zero emissions by 2050, all new buildings and 20% of existing buildings should be zero-carbon-ready by 2030. In the U.S., federal money is also fueling this shift, with $2 billion in IRA funds earmarked for federal projects utilizing low-embodied carbon construction materials like asphalt, concrete, glass, and steel.

Tech is Only Getting Better

Generative AI and other technologies offer exciting opportunities for the construction industry in 2024. AI, drones, and powerful software make it possible to take 3D modeling and rendering to new heights, improving the design process, scheduling, safety, compliance, and overall quality of construction projects. These tools will continue to improve over 2024, making “early” adopters more sustainable and ready for new challenges and legislation that might arise.

It’s Not All Positivity, Though

There are still significant challenges that the construction industry will likely have to deal with. For instance, the construction industry showed growth in 2023. However, the likelihood of this growth being related to inflation rather than actual volume is too hard to ignore. Inflation will continue to plague the industry for at least part of 2024, with interest rates remaining relatively high.

Similarly, shortages are still an issue. Skilled labor was already in short supply, with more people leaving the construction industry than are entering the field, worsening the shortage. It’s estimated that the industry will need over 340,000 new workers in 2024, and finding younger workers with the required skills will only get harder.

Materials pricing and supply chain issues will remain a factor in 2024, as well. Supply chain shortages eased a bit in 2023, but the materials costs are still high. Some materials, such as those required for tech projects like manufacturing plants remain high, and economic uncertainties are likely to keep them there for the foreseeable future.

Is the Construction Industry Slowing Down?

The construction industry is likely to slow down in 2024, but overall, construction activity looks to be stable or slightly improved. Inflation and high interest rates will continue to control how money is spent, with projects funded by federal money being in high demand, and non-residential buildings and commercial construction starts likely to slow.

Also, high interest rates and mortgage affordability will continue to be a factor in 2024, impacting an already ailing housing market, residential projects are likely to slow down despite a significant need for housing inventory. With less inventory, housing prices are expected to remain high overall in 2024.

However, funds from the CHIPs Act, IIJA, and IRA will fuel significant growth in manufacturing and infrastructure. There were multiple semiconductor manufacturing projects already underway at the start of 2024, with more scheduled to break ground later in the year. Chip manufacturing and electric vehicle manufacturing lead the way in this space, providing an optimistic and exciting view of the industry for 2024.

Planning for Labor Gaps and Shortages

The labor shortage is a challenge that the construction industry faces year after year. Skilled labor is harder to find, and increased labor costs across all industries are making it harder for construction companies to work efficiently and profitably. But there are some avenues the industry can take to ease this burden in 2024.

Construction companies will struggle to attract skilled labor, so it’s important to invest in the labor force they have. Building up existing employees by training them with new skills can help reduce the need for new employees, and retaining these newly-skilled workers with better pay and improved benefits will help dissuade staff from leaving in the future.

The search for potential workers should expand to new sources. Reaching out to a younger generation about the benefits of a career in construction could brew new interest. Trade organizations and companies should consider recruiting efforts at high schools, trade schools, community colleges, military employment events, and other individuals who may be reentering the workforce after years of unavailability.

DEI (Diversity, Equity, and Inclusion) initiatives can also play a major role. These initiatives can help attract new workers across a wider pool of eligible employees.

Finally, technology could play the largest role in easing the skilled workforce shortage. New software programs, AI, and autonomous vehicles and machines could help offset the need for a large workforce. These technologies might even attract a new type of tech-savvy construction worker, allowing companies to do more with less in 2024.

Strategizing for Unstable Prices and Costs

Economic instability will continue to pull strings controlling construction efforts in 2024. As they did when costs increased over the past few years, unstable prices and costs associated with materials, labor, and equipment will make planning projects difficult and could impact profitability.

But, there are a few tactics that construction firms can take to improve their ability to weather the storm of volatile construction costs:

- Improve cash flow by moving to fixed payment terms, ensuring there is always cash on hand to take advantage of low pricing or absorb additional costs without interest-accumulating loans.

- Focus on modular projects or pre-fab phases whenever possible to reduce waste, labor, and costs, even for nonresidential construction projects.

- Use technology like BIM and other construction software to identify alternative materials, pinpoint quantities, and make adjustments quickly when necessary.

- Communicate early and often with clients and project owners to allow for as much lead time as possible for materials, allowing construction firms to be more selective with pricing.

Supply Chain and Material Availability

Supply chains have eased a bit, and other than lead times for electrical materials and steel used in manufacturing plants, most material availability is improving. However, construction companies can improve their supply chains on their own and make the most of the materials available on the market by expanding their current supply network.

Opening new accounts with additional suppliers can do quite a lot for construction companies looking to avoid rocky shores in 2024. For one, it allows builders and contractors to shop prices and negotiate when necessary. Also, when prices are low, construction firms can purchase materials they use in bulk quantities, as long as storage isn’t an issue. Finally, when materials aren’t available through one supplier, they can shop around or find alternatives that will serve the same purpose.

How to Combat Economic Challenges in the Construction Market?

Challenges exist even when the construction forecast is great, with projects abound and borrowing is cheap (which doesn’t quite describe 2024).

When faced with economic challenges or uncertainty, the natural response is to spend less, but there are other actions businesses can take to reduce their stress. Here are few tips to help construction businesses improve cash flow and be more cost-effective by being more operationally efficient

Digitizing Processes with Construction Software Technology

One of the trends we’re seeing in 2024 is the need to do more with less, and construction technology could be the answer. Technology solutions like generative AI, wearable tech, and construction software can help you digitize processes and improve efficiency with specific tasks and processes.

Construction management software that’s integrated with accounting can help unify the field and back office and improve a firm’s efficiency by accurately allocating costs and eliminating double data entries that can result in costly errors. It can also help improve your cash flow by allowing technicians to bill directly from the job site or based on payroll hours.

However, to truly minimize profit fade and improve cash flow, service and construction businesses have to consider if they have a software solution that can produce accurate cost data and reporting on demand. Only then, can businesses know the true state of their costs at any given moment and make effective decisions to improve their bottom line.

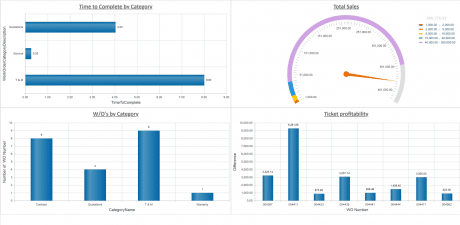

Utilizing Construction Business Intelligence and Data Analytics

Construction companies should also start focusing on technologies that can help them access accurate data to make more informed decisions. Imagine the impact you can make when you can access data like work order profitability or over/under billing analysis of projects at any given moment. With real-time data, construction firms can make more effective decisions on costly tasks like making adjustments on a project or deciding on whether or not a new subcontract would be feasible.

With reliable, accurate financial data, construction companies can confidently navigate any construction outlook they face in the future, and position themselves for success as new opportunities arise.

Move Your Construction Business Forward in 2024 with Jonas Construction

In today’s construction marketplace, staying competitive involves more than just keeping pace with the current construction outlook; it requires planning ahead for the future and with that, requires a deep understanding of your business operations, data and costs.

To help you acquire this important information, service and construction businesses can invest in construction software technology that helps them understand the true state of their costs and offer insights to continuously improve their operations,

As a comprehensive construction management solution integrated with payroll and construction accounting software, Jonas Construction Software is supported by real-time accounting to enable service and construction businesses to have accurate accounting, financial and operational data information at any given moment. As a result, businesses can use this information to make informed decisions to improve their operational efficiency, and ultimately, improve their profitability.

To learn more about how Jonas can help your business improve operational efficiency, improve cash flow and identify profit fade in 2024 contact us today or request a demo.