Last Updated on October 18, 2024

When thinking about the difference between construction accounting and regular accounting, you’re likely to consider the challenges of the construction industry such as managing cash flow, cost overruns, and compliance.

While those are all valid reasons, there are other distinctions that may not be considered when discussing the differences between construction accounting and regular accounting, which we’ll discuss further in this blog.

Most accounting professionals would agree that a financially successful business is supported by accounting practices that can produce accurate cost and accounting data to reflect the company’s financial health and profitability. Without those practices, it’s likely impossible to report on a company’s financial health.

When it comes to service and construction business, the expectations are no different on accounting personnel to owners and stakeholders. However, the challenges and requirements a construction accounting professional will face versus a “regular” accountant will be vastly different due to the nature of the construction industry.

Unlike many businesses, which have relatively simple transactions (i.e. pay the vendor and immediately exchange for the product and/or service promised), construction projects are completed over a long time period, subjected to unexpected changes in the scope of work or budget and may involve multiple stakeholders.

Due to these challenges (and many others), the financial risks to construction businesses are extremely high when you consider all the job costs, transactions and variables that run through the business for just one project.

Understanding the accounting standards and practices that need to be upheld to produce accurate cost and accounting data will be key to ensuring any construction business’ financial health and profitability.

In this blog, we’ll dig in a little more into the differences between construction accounting and regular accounting and why it matters for construction businesses to understand this.

- The Challenges that Make Construction Accounting Unique

- What Accounting Methods are Used in Construction?

- Branches of Construction Accounting: Financial & Managerial Accounting

- Support Construction Accounting with a Specialized Solution

Construction Accounting Has Unique Challenges

As mentioned previously, construction businesses are prone to encountering a number of challenges throughout the course of a project and in its day-to-day operations, which may also include maintaining service contracts and work orders.

To help you understand a little more why construction accounting is unique from regular accounting, let’s review some of the challenges the construction industry experiences and how construction accounting supports them.

Cash Flow Management

Construction projects are generally executed over a long period of time (i.e. over a period of weeks, months, or even years). During this time, a construction company will still incur costs, without receiving any payment. This could lead to significant cash flow issues for the business.

How Construction Accounting Can Support Cash Flow Management

To maintain cash inflow, a construction business can implement progress billing (invoicing method most commonly used for construction projects) to receive payment for project milestones or work completed.

They may also want to look into having a reserve fund or securing flexible credit lines to help manage cash flow shortfalls. If this isn’t an option, many construction companies will also offer a service side to their business, maintaining PMAs, service contracts and work orders to generate cash flow throughout the year.

These are just a few things that an accounting professional may have to encounter in a construction company that may not occur in “regular accounting” with a typical brick and mortar business.

Unpredictable Changes in Costs

Another challenge that comes from the lengthy process of projects is that they may go through a number of changes in costs, which include material prices, labor costs (due to labor shortages), and other expenses that can fluctuate throughout a project. These cost changes can negatively affect the budget and job profitability.

How Construction Accounting Can Support Unpredictable Costs

Anticipating changes in your labor costs and budget is not generally expected in regular accounting and is one of the issues that make construction accounting unique.

To better manage variable changes in costs, construction businesses can invest in integrated construction accounting and job costing software, which can produce real-time, accurate data to support more accurate cost forecasting and estimates. By doing so, businesses can confidently plan ahead by seeing the impact of cost changes immediately and be prepared for any adjustments.

Contract Changes and Delays

Construction projects are more susceptible to changes from the original scope of work because of the long duration of time they typically require. These changes in the work scope and contract modifications can also disrupt the project timelines and budget.

How Construction Accounting Supports Contract Changes and Delays

When changes are requested from the scope of work, change orders are required to track the impact it will have on job costs, profitability and project delivery. Construction accounting knowledge is necessary in scenarios like this as it may have a cascading effect on your costs and operations once the change order is approved.

Having a construction accounting solution that accurately calculates your profitability with each change order, establishing clear steps for change order management, and including clauses in contracts to address potential delays and cost adjustments can help you mitigate cost overruns from contract changes and delays.

Compliance to Construction Accounting Standards and Regulations

As any industry that involves multiple stakeholders and large budgets that can range upwards to billions of dollars, the construction industry is regulated and obligated to maintain certain accounting standards and compliance in order to operate and avoid penalties.

How Construction Accounting Supports Compliance and Tax Planning

In addition to staying informed on construction accounting standards and tax laws, construction accounting professionals should have a very clear understanding of their costs and finances, which starts with clean books.

Knowing how to organize and manage the business’ costs, so that the accounting data is always accurate and up-to-date requires construction accounting knowledge. Construction companies have to maintain comprehensive records to ensure compliance with tax laws, regulatory standards, and internal controls. Proper documentation not only supports strategic planning and decision-making, but also makes for a smoother auditing process.

What Accounting Methods are Used in Construction?

For an industry that has a number of unique financial challenges, the construction industry has a number of specialized accounting methods to help businesses be financially healthy and successful. These methods include job costing and revenue recognition methods.

Job Costing in Construction

Job costing is a fundamental practice in construction accounting, which helps companies track their costs on projects. The process of job costing should be detail-oriented and practiced in a timely manner to ensure data accuracy. It involves the allocation of direct and indirect costs to specific jobs, project phases and cost types in order to enable accurate cost control, budgeting, and reporting on profitability.

While job costing can be done manually with spreadsheet calculations, because it is so integral to the financial success of a project, many businesses will invest in robust job costing software to help them streamline the job costing process.

It’s important to recognize that because job costing is a method of construction accounting, the job costing solution a business chooses should also be integrated with construction accounting software and the field operations. If it’s unable to integrate with these departments in real-time, the data, as well as cost and WIP reporting may not accurately reflect the true state of the project’s and business’ costs – countering the sole purpose of why businesses perform job costing.

Revenue Recognition Methods in Construction Accounting

All construction businesses must adhere to GAAP standards (Generally Accepted Accounting Principles) in the U.S. and Canada for reporting their financial statements. One of the principles of GAAP is revenue recognition, which states revenue must be recognized the moment it is earned.

According to Investopedia, revenue recognition is important for construction companies because it helps them understand their financial health at any time and it deters businesses from producing misleading, inaccurate financial and accounting reporting.

There are a number of revenue recognition methods construction companies can practice including cash basis, accrual method, percentage of completion method and completed contract method, with the latter two being the most commonly used methods in construction accounting.

Percentage of Completion Method (PCM)

PCM recognizes revenue based on the project’s progress. This method is useful for long-term projects, as it aligns revenue recognition with the actual work completed, providing a more accurate picture of financial performance.

Completed Contract Method (CCM)

CCM defers revenue recognition until the project is fully completed. This method is often used for short-term projects or when the outcome of a project is uncertain, as it avoids premature recognition of revenue.

To learn more about the percentage of completion method or the completed contract method, visit this blog.

Branches of Construction Accounting: Financial & Managerial Accounting

When it comes to differentiating construction accounting from regular accounting, we must first understand what a ‘branch’ of accounting is.

All businesses and organizations have branches of accounting. Branches are different ways the organization will practice, track and understand financial and non-financial data that could affect the business’ profitability and operations.

According to Indeed.com, there are 12 branches of accounting, which organizations can use to measure and track their economic activity. The two that we’re going to focus on are Managerial Accounting and Financial Accounting.

The branches of accounting branches will typically:

- Support organizations to maintain accurate financial records

- Provide relevant information for decision-making purposes

- Ensure that organizations comply with financial laws and regulations

- Protect business assets

- Help calculate profit-and-loss figures

- Monitor an organization’s financial health in multiple ways

From the 12 accounting branches, all businesses, including construction companies should practice both financial accounting and managerial accounting in order to be financially successful. Let’s see how these branches can operate in construction accounting!

Financial Accounting in Construction & Regular Accounting

The primary purpose of financial accounting is to report the company’s financial health to interested parties, which include stakeholders, investors, creditors, and regulatory authorities. Because they are needed for auditing purposes, it also helps keep businesses accountable by ensuring they adhere to industry standards and regulations. In the construction industry, this would include standards like GAAP or IFRS (International Financial Reporting Standards).

Reporting in Financial Accounting

Financial accounting involves the recording and organizing of historical financial data from the company’s business transactions. From this data, businesses must be able to produce financial reporting from their financial statements (i.e. balance sheets, income statements, and cash flow statements).

Under financial accounting, the methods and processes used to produce financial reports are essentially the same in construction accounting as it is in regular accounting.

Most articles we’ve read will convey that construction and regular accounting are different. But it’s not that simple because within the branch of financial accounting, construction and regular accounting are the same.

Managerial Accounting in Construction & Regular Accounting

Managerial accounting focuses primarily on providing a company’s leadership and executive teams with insight and information on how they can run a more operationally efficient business and improve their financial health.

Here is where construction and regular accounting start to look different.

Reporting in Managerial Accounting

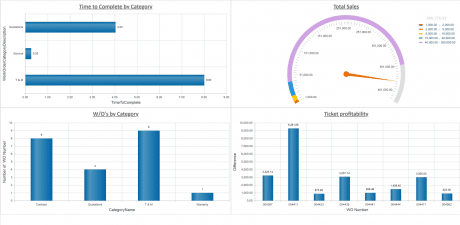

In a construction company, managerial accounting will require reporting analysis on project costs, job profitability, and operation efficiency to support informed and effective business decisions.

This is where cost and WIP (work in progress) reporting will stand out as the key differentiators in construction accounting compared to regular accounting. Remember how we keep talking about the long duration of time construction projects require?

Costs and WIP reports are important in construction because they provide financial snapshots of where a project stands throughout the project lifecycle by helping the project manager and internal stakeholders get an overview of the costs associated with a project or project phase at any point in time. By doing so, they can verify if the project is on track with the proposed budget and timeline, and make adjustments if required.

Cost and WIP reports will generally include information about the budgeted costs versus actual costs, and the variances between them. The report can also include details on labor costs, materials, and other expenses related to the project.

These reports are critical to the success of the project and business because they enable informed decision-making when issues arise or identify issues before they escalate. With cost overruns commonly occurring in projects, project managers can identify the source of their overruns with reporting and make adjustments to mitigate profit fade.

Why Managerial Accounting is Unique in Construction Accounting

In managerial accounting for a construction company, accounting professionals must analyze data from cost and WIP reporting to not only look for opportunities to improve their financial health, but more importantly, mitigate potential threats to the business and project’s success.

The construction industry’s project-based business model can make it prone to financial risks from challenges like fixed-price contracts, working on multiple projects, subcontractor management, shortages on equipment and materials, etc. As a result, managerial accounting becomes extremely important as a practice in construction accounting – arguably even more important when compared to “regular accounting” for a typical brick and mortar operation..

Managerial accounting requires a construction accounting professional who understands the proper handling of accrual entries, holdbacks/retainages, and the percentage of completion method – all of which are unique to construction accounting. Understanding how to handle these job costs and their proper allocations is key in construction accounting, while this type of analysis will not be needed in other industries.

Support Construction Accounting with a Specialized Solution

Now that we’ve established that construction businesses have to practice specialized construction accounting methods, standards and compliance in order to be financially healthy and operationally efficient, it’s important that businesses utilize robust construction accounting software to help them maximize their efforts.

Key Features to Look For in Construction Accounting Software

- Integration with the Field Operations: By enabling a field to back office integration in real-time, data can be directly entered from the field and readily processed by the back office at any time. This results in improved data accuracy and reporting, and enables more reliable reporting and decision-making.

- Job Costing and Tracking: Construction accounting software should allow for detailed tracking of project costs, including direct, indirect, and overhead expenses. In addition, you should be able to build more accurate forecasts to support data-driven planning.

- Revenue Recognition: Ensure your software supports percentage of completion method and completed contract method to ensure accurate revenue recognition.

- Cost & WIP Reporting: Assess the templated reports offered, as well as flexibility to generate customized reporting to address specific business concerns, in addition to project profitability and overall financial health.

- Compliance Management: Verify if the software will support automated tax calculations and regulatory compliance features like GAAP to streamline the management of legal and financial obligations.

To help you learn more about construction accounting software or guide you in a purchase, please check out:

- Guide to Accounting for Construction Companies.

- The Best Construction Accounting Software for Contractors.

- A Guide to Choosing Construction Management Software With or Without Accounting

The unique nature of the construction industry can make it more susceptible to financial challenges that other brick and mortar businesses don’t have to be concerned about. As such, construction accounting requires specific and detailed accounting methods to not only ensure compliance to industry standards and regulations, but to also support the financial health and growth of the business.

Construction companies who wish to maintain their financial data accuracy and integrity should consider integrated construction accounting software – software that can unify their field and accounting operations together in real-time.

When cost and revenue data flow directly from the field to the back office, business owners and stakeholders can stay apprised of their latest cost and financial updates and produce accurate, timely reporting in order to make effective decisions.

If you’re interested in learning more about Jonas’ integrated construction accounting software, please reach out, we’d love to chat!