Last Updated on October 5, 2023

As a service or construction business, you might be wondering what programs are available to help you earn some extra cash. In Canada, there are a number of great grants and incentive programs for corporations like yours. However, finding all of the funding and tax credits that you’re eligible to receive can be pretty time-consuming and cumbersome… until now!

To make it easier, we’ve compiled the ultimate resource list for Canadian contractors to save more money this year and in the years to come. Use this list to reduce the amount of taxes that your business is required to pay and take advantage of all the assistance that’s available to help your business succeed.

Keep reading until the end of this article to learn another way businesses in the construction industry can save money and improve profitability!

Incentives, Grants, Tax Credits and Rebates for Service and Construction Businesses (by Location)

The following tax credits, rebates, incentives and grants are organized by location, starting with Canada-wide programs and followed by provincial programs. To find out whether you qualify for any of the programs listed below, simply click on the links to review the eligibility requirements and learn more about the application process.

Note: We have excluded certain provinces from this list if there is limited government support available for service and construction businesses in the area.

National Resources

Alberta Resources

British Columbia Resources

Manitoba Resources

Ontario Resources

New Brunswick Resources

Newfoundland & Labrador Resources

Nova Scotia Resources

Quebec Resources

Saskatchewan Resources

Yukon Resources

National Resources

The federal government offers the following programs for construction companies and other corporations:

- Canada Small Business Financing Program: A program that makes it easier for small businesses to get loans for land improvement, commercial buildings, equipment purchases, and more.

- Canada Summer Jobs Grant: A grant program that subsidizes wages for full-time youth employees throughout the summer.

- Federal Foreign Business Income Tax Credit: A tax credit that prevents double taxation for corporations that pay foreign tax.

- Scientific Research and Experimental Development Tax Incentive: A tax incentive program that supports Canadian businesses conducting research and development.

Alberta Resources

- Canada-Alberta Job Grant: A funding program that covers ⅔ of the overall training costs for employees.

- Scientific Research and Experimental Development Tax Credit: A tax credit that supports Alberta-based businesses conducting research and development.

British Columbia Resources

- BC Employer Training Grant: A funding program that reimburses the cost of skills training based on provincial labour market needs.

- Training Tax Credit: A tax credit for employers who employ apprentices through the International Training Authority apprenticeship programs.

- Scientific Research & Experimental Development Tax Credit: A tax credit that supports BC-based businesses conducting research and development.

Manitoba Resources

- Industry Expansion Program: A program that provides financial assistance for employee skills training and training program development.

- Sector Council Program: A funding program that helps organizations in sectors such as construction provide workforce training to support business growth.

- Workforce Development Program: A program that provides funding support for training and HR development.

- Paid Work Experience Tax Credits: Tax credits that reimburse employers for a percentage of the wages paid to recent graduates and trainee employees.

- R&D Tax Credit: A tax credit that supports Manitoba-based businesses conducting research and development.

Ontario Resources

- Apprenticeship Training Tax Credit: A financial incentive program that supports employers who hire and train apprentices.

- Co-operative Education Tax Credit: A tax credit available to employers who hire co-operative education students enrolled in an Ontario university or college.

- Regional Opportunities Investment Tax Credit: A tax credit available to Ontario businesses who make a qualifying investment in a designated region of the province.

- Job Creation Investment Incentive: Income tax relief for certain green energy equipment, manufacturing and processing machinery and equipment, and certain capital investments.

- Canada-Ontario Job Grant: A program that covers a certain percentage of employee training costs based on the size of the organization.

- Ontario Innovation Tax Credit: A tax credit that supports Ontario-based businesses conducting research and development.

New Brunswick Resources

- Labour Force Training Program: A funding program to cover skills training costs for prospective and current employees.

- R&D Tax Credit: A tax credit that supports New Brunswick-based businesses conducting research and development.

Newfoundland and Labrador Resources

- Canada-Newfoundland and Labrador Job Grant: A program that offsets employee training costs for Newfoundland and Labrador-based businesses.

- Economic Diversification and Growth Enterprises Program: An incentive-based program for local companies that want to expand their presence in Newfoundland and Labrador and national or international organizations that want to establish a new enterprise in the area.

- R&D Tax Credit: A tax credit that supports Newfoundland and Labrador-based businesses conducting research and development.

Nova Scotia Resources

- Workplace Innovation and Productivity Skills Incentive: An incentive for businesses to invest in training to compete with businesses outside of Nova Scotia.

- START Program: A wage incentive program and additional funding for employers who hire an unemployed Nova Scotian.

- New Small Business Tax Deduction: A deduction for new small businesses that eliminates provincial corporate income tax for 3 taxation years after the business is incorporated.

- R&D Tax Credit: A tax credit that supports Nova Scotia-based businesses conducting research and development.

Quebec Resources

- R&D Tax Credits: A tax credit that supports Quebec-based businesses conducting research and development.

Saskatchewan Resources

- Canada-Saskatchewan Job Grant: A funding program that covers ⅔ of the overall training costs for employees.

- R&D Tax Credit: A tax credit that supports Saskatchewan-based businesses conducting research and development.

Yukon Resources

- Staffing UP Wage Subsidy: A program that helps businesses hire new employees by subsidizing their wages.

- Rebate for Construction Materials Made in Yukon: A rebate for Yukon-made construction materials that are used for a Government of Yukon construction contract.

- Apprentice Rebate Program: A rebate for businesses that hire registered Yukon-based apprentices.

- Labour Rebate for Construction Workers: A rebate for general contractors and subcontractors who hire Yukon residents for their construction projects.

- Economic Development Fund: A fund that supports projects contributing to the economic growth of Yukon.

- R&D Tax Credit: A tax credit that supports Yukon-based businesses conducting research and development.

How to Save Even More Money in the Construction Industry

Now that you have a better understanding of the funding programs, tax credits, and incentives that are available to your company, you’re already on track to improving your bottom line. As you might have noticed, many of these programs also provide incredible opportunities for business growth, allowing you to invest in more training and expand your service or construction business into new areas.

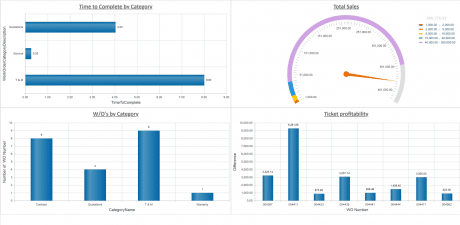

In addition to the programs outlined in this article, another way that contractors can save money and increase their profitability is through an investment in construction management software.

At Jonas Construction, we pride ourselves on being able to help service and construction businesses like yours maximize their profits with our industry-leading ERP software. Our accounting, service management, project management and operations features can help you streamline your processes, cut out tedious and unnecessary tasks and increase your productivity so your company can spend more time on billable work.

Take the next step towards better profit margins and more money in your pocket. Contact us or request a demo today!