Last Updated on July 3, 2024

Most construction and service companies operate by allowing a portion of their trades to be on credit. When your company extends credit to customers for a job completed or services provided, the amount owed is referred to as “accounts receivable”. But what is accounts receivable when it comes to construction accounting? How do you manage your accounts receivable so that it benefits your business? Is accounts receivable considered an asset and how should it be classified in your financial record keeping?

Let’s get started!

First of all, yes, accounts receivable is an asset, because it’s defined as money owed to your construction or service company by a customer and also because it’s convertible to cash in the future.

If accounts receivable is an asset, it’s basically money in the proverbial bank, right? Not exactly. In the construction accounting world, accounts receivable is a kind of cash inflow “in waiting.” It’s cash legally owed to you, which in theory is good, but it’s not yet cash in hand.

Managing the accounts receivable is extremely crucial for your construction and service business. It’s where you withdraw money to pay your employees, cover your company’s daily expenses, and grow your company. In essence, your day-to-day operations depend on accounts receivable. This is why payments must be collected in a timely manner and in a way that is beneficial for your construction business.

How do you manage your accounts receivable so that they yield the most benefit? Find out everything you need to know about accounts receivable with our comprehensive guide.

What is Accounts Receivable in Construction

When you have completed a project or performed service, but you have yet to be paid for it, that money is still owing to you. Cash “to be received” is filed as accounts receivable (AR).

Importance of Accounts Receivable in Construction Accounting

Now that we know what it is, let’s learn why accounts receivable is important.

At a high level, AR is important because it affects your cash flow. All phases of construction have risks, but payment delays and nonpayments can be the most dangerous ones – especially for your cash flow. Payment issues can expose your construction business to even greater financial risks if not addressed on time. Payment delays can even threaten the life of your construction business.

When you think about it, accounts receivable is kind of a no-man’s land between money inflow and outflow. It will become cash but isn’t yet. And since you have already made the delivery of a service or have completed the project, it’s a cash outflow. That’s why the second step is just as important: collection.

Think of accounts receivable as mini loans to your customers. With this in mind, construction contractors should always stay on top of customer accounts and pay especially close attention to those that are significantly past due. Some businesses simply don’t realize how much cash is trapped in their balance sheets!

Long periods between the billing and collection are typical for the construction industry. To pay for expenses and payroll, you may end up draining your cash reserves. The quicker the turnaround on accounts receivable, the better. If your customers are paying late, then your construction business may need to borrow money to meet its obligations. You could also incur losses on the financing charges. Overdue AR drains your cash flow. Rather than investing free capital in growth opportunities, buy new equipment or introduce new services, your money is locked up on your balance sheet.

The challenge in AR is reducing the time between the delivery of your product/service and the collection. Great, you’d say, but how?

Out tips below will help you achieve the following:

- Your collection process will be improved.

- You will easily identify reasons for nonpayment.

- You will proactively remind the overdue accounts.

Here are six tips on making your accounts receivables more efficient.

- Make Good Decisions About Who You Offer Credit To

Just as bankers assess the credit risk associated with their loan applications, you have to evaluate the credit risk associated with extending credit to your customers. To avoid unintended consequences, it’s a good idea to determine customer creditworthiness before you offer credit. Here are steps you can take:

- Run a credit report to review a businesses’ credit score.

- Ask for references: these could be the customer’s bank, as well as businesses or suppliers that already offer trade credit to that customer.

- Check the businesses’ financial standings: don’t be shy to ask for a certified financial statement. You can use this statement to calculate the company’s debt-to-income ratio. To calculate the ratio, simply divide the company’s monthly debt payments by gross monthly income – all these numbers are shown in the statement.

With the customers that match your criteria, you need a process – precise and succinct policies for issuing credit and recovering debt in a timely fashion. It’s also a good idea to have a process for customers that don’t match your criteria, that are potentially higher risk, should you decide to do business with them. An inappropriately high credit limit may put your accounts receivable at risk.

- Clearly State your Terms and Past Due Penalties

A sound credit policy is critically important for a construction business. If you do not collect money as soon as your job is done, then you are basically giving your clients a loan. While there’s nothing wrong with giving credit, you need to clearly define the terms of your credit and what consequences occur if these terms are not met.

Having a solid credit policy is especially important if you offer trade credit. Many businesses, especially in construction trades such as carpentry, renovations, and roofing, rely on trade credit. Trade credit is the interest-free credit extended by suppliers that allow contractors and service providers to buy materials and goods now and pay for them later, usually by an agreed deadline.

Trade credit can be a good way to build customer base, gain competitive edge, and establish a good relationship with suppliers – but there are risks. Without a solid credit policy, it can be difficult to recover the money. You may need to consider several things when deciding to grant trade credit to a business, among them:

- Trading history: How long the business has been around.

- Risk: Consider shorter repayment deadlines and lower credit amounts for new, unproven businesses.

- Types of goods: Typically, construction materials have long shelf life so they warrant longer repayment deadlines.

To improve your accounts receivable, your credit policy should outline your business’s billing procedures and include the steps of collecting on overdue accounts. Additionally, you’ll need to have procedures in place for dealing with late-paying accounts. The goal of enforcing your credit policy is to have your customers treat their obligations more seriously and pay you on your terms.

With a credit policy, it’s a good idea to set expectations right from the start and communicate your credit terms before work begins.

- Provide Early Payment Incentives

Everyone likes freebies or rewards, right? You can use this mindset to make customers actually want to pay you—early and on time.

Consider creating incentives for customers to help collect that owed balance. You could try:

- Discounts and bonuses.

- Offers, for example, free service maintenance.

- Future credits for early payment.

This will not only help you improve your bottom line, but it will increase the likelihood of turning a customer into a repeat one.

Here’s another example. A common early payment discount that construction businesses offer is a 1% discount if a customer pays within 10 days. This policy can be useful for improving cash flow or to lessen the risk of not being paid, especially with a large invoice amount.

You can also take the opposite approach and introduce late payment fees as a preventative measure. While this may look like a logical way to encourage people to pay on time, think carefully: You want to keep repeat business and drive cash flow. Consider the payment history and loyalty of a customer before hitting them with a fee. Be clear about the fees in your credit policy and apply them fairly.

- Automate the Invoicing Process

To be effective, the billing and invoicing must be accurate, timely, and streamlined. One way to improve invoicing is by automating as much of it as possible. The more you can remove the human element, the more precise and infallible the entire AR process will be.

Gone are the days when snail mail was the only way to land invoices on the clients’ desks. Paper invoices are easy to lose and time-consuming to track. With construction accounting software, invoices can be sent automatically as soon as the projects are completed, so there’s no need to stick to monthly cycle billings. The best practice is to set up a customer portal so your customers can enjoy a sense of autonomy over their invoices and payments.

Automation is not just one way you can reduce time and human error. There’s one more strategy you can use to bolster your construction AR efficiency.

- Invoice from Your Mobile Device

How many times have you or your techs made a note to yourself to create a service invoice when you come back to the office – only to forget about it with your busy schedule? With mobile invoicing, you can send a bill to your client immediately after delivering your service or completing a job. When your customer receives a payment request in their email, they can pay online from anywhere by entering in their card information. A good mobile solution will also ensure you can view the history of the invoice, as well as communicate with your client on it from mobile devices.

Among other less obvious benefits of mobile invoicing are:

- Faster payments: When the invoice is sent automatically and instantly, it influences your client to pay their bill more quickly.

- Standardized invoicing process: Mobile invoicing eliminates additional invoicing steps and minimizes errors.

- Better data management: Sending and tracking invoices becomes a lot easier, as the administrative burden is alleviated.

- Easier for your clients: It’s likely that your clients are receiving tonnes of invoices. With mobile invoicing, you can help to reduce the amount of clutter on your clients’ desks and increase the likelihood that they’ll get to your invoices more quickly.

The easier you can make it for your clients to pay you, the faster you’ll get your money.

Even if you use automated and mobile invoicing, it is a great way to improve your invoicing processes! – you can take yet another step to safeguard your cash flow.

- Keep Good Track of Your Records

Keeping track of overdue invoices and incoming payments is crucial to the success of your construction business; the cash flow of your company depends on them. Organization guru Marie Kondo may not have been talking about accounts receivable, but it certainly applies: “To put things in order means to put your past in order, too.”

There are a few steps you can take to track your accounts receivable. One of them is implementing a document management system. All business transactions will be documented in a paperless form, so all your financial records become easily accessible. Another important step is backing up and securing your data. Storing financial records on cloud-based software lowers the risk of losing them.

When managed properly, accounts receivable records will show you how much cash is tied up in balance sheets (and thus not available to you) and for how long. You may also be able to track a few other important metrics, such as:

- Days Sales Outstanding (DSO): This is the average amount of time it takes to collect payment. This is the main metric you want to reduce while optimizing AR processes, aiming to keep it below 30 days.

- Average Days Delinquent (ADD): This metric shows how many days on average client payments are overdue. This is another number you want to keep as low as possible. If it goes up, make sure your billing is going smoothly and AR department is adequately dealing with collections.

- Turnover ratio: This number indicates your cash flow. It shows you how quickly you’re collecting revenue from clients (i.e. turning accounts into cash). Ideally, this number should also be low. A lot of open accounts with uncollected revenue will result in high ratio, which is a sign it’s time to revisit your credit policy and collection processes.

Taking Your Accounts Receivable to the Next Level with Construction Accounting Software

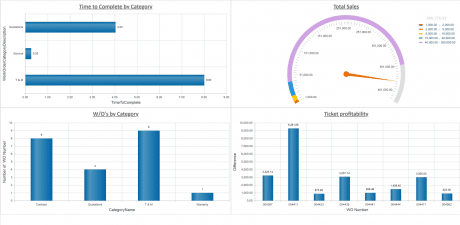

Construction accounting has many unique attributes compared to traditional business accounting. While the way accounts receivable works in construction-specific accounting software may look familiar, what it does differently is tracking each job or work order while displaying a holistic view of all your accounts receivable.

More specifically, it allows you to easily manage billings and customer payment history, view, and drill down into billing information by customer, jobs, or service work orders. A customer portal can reduce manual hours dealing with payment tracking disputes, collections, and more.

So, as your projects and service contracts give you more than enough to stay busy, streamlining your accounts receivable can be surprisingly easy if you let the construction accounting software do the heavy lifting.