Last Updated on February 5, 2024

From Alberta to Vancouver, Saskatchewan to Manitoba, and even Newfoundland and Labrador, construction companies across Canada had to adapt significantly to survive and overcome the COVID-19 pandemic. So, now that the pandemic is almost behind us, how does the future look for Canada’s construction industry? More importantly — what can construction companies do to keep up with industry growth and address the industry’s biggest challenges?

In this article, we’re taking a look at 30+ key Canadian construction statistics that provide an important overview of the state of the industry and the issues that Canadian contractors face. Stay tuned until the end of this article to find out the best way to be successful in the Canadian construction industry post-pandemic.

General Outlook of the Canadian Construction Industry

There is light at the end of the tunnel for the construction industry in Canada! Although the industry’s growth will be more modest compared to the ten years pre-COVID, the Canadian construction industry is expected to rebound in 2021. Among the driving forces of the industry’s resurgence are the recovery in consumer and business confidence and the global demand for Canadian exports. The non-residential sector will fuel the industry growth, with more public transit, health care, education, roadwork, and other civil infrastructure projects coming into full force by 2023.

Overall Canadian Construction Spending Is Expected to Grow

The growth of the Canadian construction industry is a welcome upward trend that replaces the decline in 2020 due to the economic consequences of the COVID-19 pandemic.

Here are some key statistics that prove Canada’s construction industry is on the mend in 2021:

- Total investment in building construction increased 6.3% to $19.9 billion in April 2021. (Statistics Canada)

- Following a decline of 3.4% in 2020, Canada’s construction industry is now predicted to grow by 0.6% in 2021. (Businesswire)

- $91 billion in spending is predicted for machinery and equipment, almost compensating for the 13.4% decline recorded in 2020. (Statistics Canada)

Canadian Building Permits Are on the Rise

Building permits are a leading indicator of growth for the construction industry since the “…issuance of a building permit is one of the first steps in the construction process”, according to Statistics Canada. As we begin to see an increase in building permits in Canada, we will also see growth in the industry as a whole.

- The number of building permits reached a record high total value, up 8.2% to 9.9 billion dollars (about 7.8 billion U.S. dollars) in January 2021. (Statistics Canada)

- Between January 2021 and April 2021, the total value of work permits increased from $7,868,080 to $11,234,386. (Statistics Canada)

Non-Residential Construction & Machinery Spending Grows

As previously mentioned, non-residential construction in Canada is leading the charge and showing the most promise out of all the construction sectors. Specifically, the transportation and warehousing sector is expected to drive the most investment in Canada this year. (Statistics Canada)

- Capital expenditures on non-residential construction and machinery and equipment are expected to increase 7% to $266.2 billion in 2021 (Statistics Canada).

- Capital spending by public sector organizations is expected to increase by 9.3%. (Statistics Canada)

- Non-residential investment increased 0.9% to $4.6 billion in April 2021. (Ontario Construction News)

- A record $47.9 billion is anticipated in the transportation and warehousing sector in 2021. (Statistics Canada)

Among the other industrial sectors planning to increase their capital expenditures in 2021 are:

- Mining and quarrying

- Oil and gas extraction

- Pipeline transportation

Commercial Building Construction Continues to Struggle

Investment in commercial building construction, however, declined in most provinces except Quebec and Ontario. This data is partly due to the construction of high-value office buildings in Toronto and Ottawa (Statistics Canada). After the turbulent year of 2020, it’s no surprise that growth predicted in some segments of the construction market will be accompanied by a decline in others.

- In February 2020, commercial construction grew 1.5%, reaching $3 billion, despite the fact declines were reported in six provinces. (Ontario Construction News)

- Ontario commercial construction grew 2.7%, reaching $1.1 billion in February 2020. (Ontario Construction News)

- Quebec commercial construction grew 3.5%, reaching $650.4 million in February 2020. (Ontario Construction News)

- In April 2021, commercial investment continued to grow slightly by 0.3%, although only Ontario and Prince Edward Island have exceeded pre-pandemic levels. (Statistics Canada)

Residential Building Construction Shows Promise

Residential construction is another area with promising growth in recent months. However, the previous prediction that residential construction would increase substantially in 2020 didn’t necessarily come to fruition. Nevertheless, the following statistics show that the sector is on track for a good year in 2021.

- Investment in residential construction increased 8.1% to $15.3 billion in April 2021. (Statistics Canada)

- Investment in single-unit residential construction increased 8.9% in April 2021, with all provinces except for Nova Scotia reporting growth. (Statistics Canada)

- Investment in multi-unit residential construction increased 7.2% to $6.7 billion in April 2021, with the largest growth reported by Quebec. (Statistics Canada)

Construction Industry Issues in Canada

COVID-19 dealt a massive blow to the construction industry in Canada, which employs approximately 7% of the country’s workforce, or nearly 1.2 million men and women. As the storm is passing, the construction industry is generally expected to rebound swiftly since it came out relatively unharmed compared to many other industries. While construction activity in most Canadian provinces and territories is expected to bounce back, Canadian construction companies are still facing a few common challenges that continue to hold them back.

Productivity Challenges

Construction’s slackening performance is a common concern across the world’s economies (McKinsey & Company), and Canada is no exception. Among the causes of reduced productivity are skills shortage, lack of risk management and planning, project delays, and poor project management. Running construction projects, involving large numbers of workers, is complicated when the processes rely on using paper spreadsheets, leading to various financial leakages and inefficiencies.

- Between 2018 and 2019, labour productivity in the Canadian construction industry decreased 1.6% compared to 0.5% for the general Canadian economy. (Government of Canada)

- Over the past two decades, labour-productivity growth in construction averaged only 1% per year, compared to 2.8% for the total world economy. (McKinsey & Company)

- 64% of construction professionals cite increased productivity and efficiency as key success factors post COVID-19. (Cision)

- 70% of construction companies report less productivity or equal productivity compared to pre-pandemic levels. (Procore)

Increasing productivity would mean that construction companies could provide better value to customers and improve their profitability. If labour productivity in construction caught up with the total economy, the industry’s value would increase by an estimated $1.6 trillion. (McKinsey & Company)

Shortage of Skilled Workers

In Canada, around 1.4 billion people work in the Construction Industry (On-Site). Similar to many other industries, Canadian construction is not immune from the wave of baby boomers coming close to retirement in the next few years. The urgency of hiring younger contractors was put on hold by the pandemic which resulted in short-term job losses, but the overall trend hasn’t been dramatically overturned by COVID. The Canadian construction industry still needs more skilled workers to meet current and future demands.

- In the next decade, an estimated 22% of Canada’s 2019 construction labour force will retire. (On-Site)

- The Canadian construction industry is predicted to lose between 30K (On-Site) to 100K (The Globe and Mail) workers in the next 10 years.

- In Ontario, construction employment is set to increase by 6% over 2020 construction workforce levels, or up to 65,000 workers will need to be hired to replace retirees and keep pace with demand the next decade. (Globe News Wire)

High Material Costs and Supply Shortages

Another pandemic-related challenge faced by the construction industry is the increase in material costs. Additionally, construction businesses faced unpredictable delivery times and extended transit times on construction sites due to low material supply.

- During the COVID-19 pandemic, the price of mainstay construction materials rose upwards of 300%. (Journal of Commerce)

- In the first quarter of 2021, rebar prices have increased by almost 50%. (Journal of Commerce)

- The price of structural steel has also increased by almost 50% in the first quarter of 2021. (Journal of Commerce)

- Gas prices have increased an average of 40 cents in the first quarter of 2021. (Journal of Commerce)

Among items in short supply are:

- Aluminum, concrete, steel, gypsum board

- Lumber, plywood, and engineered wood products

- Plumbing items

- Doors and windows

- Roof trusses and joists

- Asphalt shingles

How Your Construction & Service Business Can Keep Up with Industry Growth & Mitigate Industry Issues

The growing construction industry in Canada means more potential work and income for your business, as long as industry issues don’t hold you back! As promised, here is the best way to keep up with your competitors and be successful in the Canadian construction industry post-pandemic: ERP software!

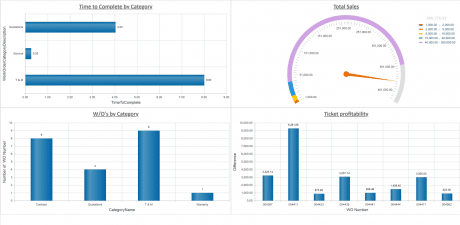

As more work comes your way, you need to be able to handle projects more efficiently and effectively, especially with a shortage of skilled workers. Jonas Construction software helps you automate tedious processes to increase your productivity and eliminate the risk of manual errors. With the help of mobile solutions and dispatch scheduling features, technicians can complete more work from the field, and you can ensure the right technicians are scheduled for each job to boost productivity further.

Additionally, the scarcity and rising cost of materials make it especially important to use reliable service management, job costing and estimating software to stay on top of your budgets and costs to ensure the profitability of your business.

Jonas Construction Software Can Help Your Business Get Ahead

Now is an exciting time in the Canadian construction industry. The Compound Annual Growth Rate (CAGR) of 8.5% by 2024 makes Canada’s construction sector worth more than $430 billion. After a rough year, the potential for recovery and growth in 2021 is strong. The industry gains back its strength and revives most of the projects that were put on hold or delayed due to the global pandemic. Skyrocketed by the global pandemic and all things remote, tech is changing everything in the construction and service industries.

Are you using all the tools you need to adapt to the future of work? In order to be the best, you need to take advantage of the best tools available. Jonas Construction Software offers 30+ years of industry expertise and is trusted by over 14,000 users. Let Jonas Construction and Service Management Software connect your data, workflows, and technology to help your business thrive. Contact us or request a demo today!