Last Updated on July 15, 2024

Due to the distinct nature of the construction industry and its project-based business models, service and construction companies need to consider construction accounting practices and methods in order to maintain accurate cost and operational data.

In this article, we will provide construction companies and contractors a more comprehensive understanding of what construction accounting is and why it is critical for your success. You will learn about the differences between accounting for construction companies and regular accounting, concerns that should be addressed with construction accounting and methods for recording construction accounting.

In this guide:

- The Difference Between Construction Accounting vs Regular Accounting

- Is Construction Accounting Difficult?

- Types of Accounting Methods Used in Construction

- Accounting Standards Used in the Construction Industry

- How Do You Record Construction Accounting?

- What Accounting Software Should Construction Companies Use?

- Streamline Your Accounting Processes with Integrated Construction Accounting Software

The Difference Between Construction Accounting vs Regular Accounting

First things first, construction accounting and regular accounting are not the same. Understanding the nuances between construction accounting and regular accounting is crucial for those involved in the financial management of construction projects and work orders.

While many industries like retail or manufacturing operate on standard accounting principles, construction accounting stands apart due to the unique nature and challenges of the service and construction industry.

That said, in order to understand the differences between construction accounting and regular accounting, it’s important we start with the similarities.

Fundamentally, construction businesses and other businesses are organized the same in terms of recognizing costs and revenues.

Costs and revenues are generated (via Projects, Franchises or Departments) and may be recognized as individual cost/profit centers, and definitely recognized as contributors of the larger corporation.

However, unlike businesses that offer products or services from a fixed location at a fixed price, i.e. A restaurant selling a piece of cake for $10, construction businesses deal with a high degree of variability. Each work order or construction project is distinct, with customized work, different locations, fluctuating costs, timelines, and billing schedules. While jobs may have similarities, every job is different, which can make construction accounting far from a piece of cake. (Pun intended.)

Accounting Branches: Financial Accounting and Managerial Accounting

Both construction accounting and regular accounting have the accounting branches of financial accounting and managerial accounting. Combined together financial accounting and managerial accounting can help construction business owners, accounting professionals and project managers understand the business’ financial status, make cost-effective business decisions and assess their profitability on jobs and projects.

Financial Accounting Reports in Construction Accounting vs. Regular Accounting

In financial accounting, accounting professionals are responsible for managing and monitoring the reports from financial statements (income statements, cash flow statements, etc.) and financial data (sales revenue, cost of good, etc.). In addition to this, they also must ensure the company is adhering to industry standards and regulations.

Under financial accounting, the methods and processes used to produce financial reports are essentially the same in construction accounting as it is in regular accounting.

Managerial Accounting Reports in Construction Accounting vs. Regular Accounting

In construction managerial accounting, accounting professionals analyze data using both cost and WIP reports to help a company meet business goals as well as identify potential threats and opportunities. In a service and construction business, this will help a business be more operationally efficient and mitigate cost overruns.

Due to the construction industry’s project-based business model, (which includes, but not limited to fixed-price contracts, multiple projects, subcontractor management, shortages in labor, equipment and materials) managerial accounting becomes extremely important for construction businesses to maximize their profitability.

Cost and WIP reports are used to assess business goals, profitability and inefficiencies. Managerial accounting requires a construction accounting professional who understands the proper handling of accrual entries, holdbacks/retainages, and the percentage of completion method for long-term job projects in the construction industry. Understanding how to handle these job costs and their proper allocations is key in construction accounting, while this type of analysis will not be needed in other industries.

In this next section, we’ll expand on some of the elements discussed above that make construction accounting different from regular accounting.

Project Based

Construction companies primarily operate around projects with varying costs, resources, timelines, and billing schedules, whereas other businesses have more stable and predictable costs and profit centers. In non-construction businesses, each branch or division of the company operates as a standalone entity that is responsible for contributing to the company’s bottom line. For example, a restaurant might have multiple franchise locations.

In contrast, most construction projects are custom jobs with unique requirements and a variety of associated costs. Although two projects may have similar requirements, several factors including labor and equipment availability, site conditions, subcontract management, and change orders can result in entirely different costs.

Therefore, it can be helpful to view each project as an individual profit center. Although projects are constantly opening and closing and have unique requirements that change based on a number of factors, tracking project profits and losses separately will help you ensure you can track profitability.

The project-centric nature of the construction business necessitates a unique method of tracking costs and expenses for each job. This is where job costing comes into play. It allows construction businesses to track project costs and assign them to the correct cost and phase types, providing accurate financial reporting and profitability insights.

If a construction and service business were to disregard construction accounting practices and only use general accounting practices, they may encounter a number of issues, which affect their profitability and cash flow. Some of these issues can include inaccurate financial reporting due to the lack of tracking detailed project costs, inability to accurately assess job profitability due to challenges with proper job cost allocations, and failing to meet accounting standards and compliance.

Field and Mobile Work

The construction industry’s mobile nature requires a unique approach to accounting and resource management. Unlike other industries where work is done at a fixed location, service and construction businesses have to manage the accounting of their operations that are constantly “on-the-go”.

Equipment and labor have to be moved from site to site to different jobs. This means that you have to consider mobilization costs such as travel time, insurance, fuel expenses, and other related expenses for each job. It also means that you need to manage your inventory, equipment, and labor effectively to ensure that you have the right tools and materials when, and where, you need them to complete each job.

Delays or mismanagement of resources across the job sites can disrupt work, potentially leading to breakdowns and increased costs, which could impact the profitability of a project, service contract, or business overall.

Irregular Costs

The next accounting challenge that service and construction companies face is ever-changing costs.

While most businesses have fairly stable overhead costs, (fixed costs are pre-determined and variable costs are tied to production levels), construction businesses, conversely, face more volatility in fluctuating costs.

The costs in construction can vary significantly during the project lifecycle due to factors like material price changes, labor availability, change orders, weather conditions, and unforeseen site challenges. Construction businesses must do their best to account for these heavily fluctuating costs when they go to estimate project timelines and budget, in order to bid for a project. For construction businesses to accurately forecast and predict their costs is generally more difficult due to the nature of project work.

To add to the challenge, it can also be difficult for construction companies to differentiate costs (overhead costs, indirect project costs, direct project costs) and ultimately ensure their accurate allocations.

If you’re unsure of how to differentiate overhead costs, generally speaking, ask yourself, “Would I still have these expenses if I didn’t have these contracts?” Though to be clear, indirect costs can include salaries, security, admin – costs that are needed to support business operations, and can be partially allocated to a particular project.

Properly categorizing and allocating costs is critical for financial reporting and determining the profitability of each project and the business as a whole.

Is Construction Accounting Difficult?

Now that we’ve explained how construction accounting differs from regular accounting, you might begin to assess that construction accounting is more difficult to manage as it poses several challenges due to the nature of the construction industry. Let’s explore that a bit further.

Each construction project, work order, PMA is unique, with diverse requirements, schedules, resources and costs. Not to mention the fact that businesses have to manage the concerns of clients, multiple stakeholders, regulatory standards and frequent changes to the project scope.

To be prepared to manage construction accounting and finances for a business, accounting professionals and owners/executives should be aware of some of the challenges they may face in their role. Let’s learn more about some of the construction-related challenges that can make construction accounting difficult to manage.

Cash Flow Management

While some service and construction companies perform short-term work with service contracts, construction projects typically extend over months or even years, involving significant upfront costs and long payment cycles.

The irregular cash flow pattern complicates the process of revenue recognition and effective management of cash flow. Moreover, insufficient cash reserves to cover ongoing expenses can create significant challenges in making timely payments to suppliers, labor, or subcontractors, adversely impacting stakeholder confidence and project timelines.

As a basic example, if your project is set to incur high material costs in Month 4, it’s important that leading up to Month 4 there be enough cash to pay the suppliers for their material.

Cost Overruns

Cost overruns happen when actual costs exceed the estimates.

This is important for businesses that engage in one of the most common types of contracts – fixed-price contracts, where every cost incurred beyond the original estimate, eats into profits (commonly referred to as Profit Fade).

And with nine out of ten construction projects experiencing cost overruns, service and construction businesses must face this reality.

The challenge becomes – How might businesses address concerns around cost overruns and profit fade, without reducing the quality of work?

3 fundamental options emerge:

- Reduce their costs

- Increase their profit

- Or Both

While some causes of cost overrun are controllable, others are not.

The common causes of cost overruns are fluctuating labor, volatile material costs, changes in project scope, change orders, poor planning, or errors in initial estimates.

While businesses may not be able to control the weather, material costs, or poor planning (after the fact), businesses who want to reduce costs, increase profits, or do both, may want to find ways to identify and optimize work that is costing time and energy. For example, duplicate entry creates double the amount of time spent on one task while also increasing the risk of cost data being entered or allocated incorrectly.

Compliance with Tax Laws & Regulations

Service and construction contractors must adhere to industry-specific accounting standards and regulations, including tax laws, which can be intricate and vary from one state or province to another. Moreover, the industry relies on a varied workforce, including temporary labor, unionized workers, and subcontractors. For the most part, businesses that are not project-based like construction, don’t have to worry about these concerns.

With all these concerns to take care of, service and construction businesses are at risk for payroll mismanagement, administrative burdens, penalties and legal issues if these concerns are not regularly observed and maintained.

As you may notice, managing and coordinating around all these challenges can make construction accounting more difficult for accounting and payroll personnel and increase the overall risk to the business. The challenges are further exacerbated when there’s no visibility into real time data on your costs to predict cash flow or make informed assessments to reduce profit fade.

In order to cope with the challenge of compliance in construction accounting, businesses may want to consider a system or technology that is capable of easing the burden on staff. For example, utilizing construction software that allows you to more efficiently manage unionized vs non-unionized payroll, temporary labor, taxes, benefits and fringes, may help reduce the time and energy it takes for certain personnel to complete their work.

Additionally, some construction software integrate the field and back office in real time to provide more accurate and timely tracking of costs incurred. This reduces duplicate entry work, lowers reliance on integrations, and improves the accuracy of data so that construction accounting professionals, project managers and owners/executives can access and create cost and WIP reports for insights into their costs and operations.

To learn more about selecting construction accounting software, skip to What Accounting Software Should Construction Companies Use? or continue below to learn about the different types of accounting methods used by construction companies.

What Type of Accounting is Used in Construction?

We’ve discussed how the industry’s challenges with cost overruns, cash flow predictability and maintaining regulatory standards necessitates accounting professionals to adopt specialized construction accounting practices.

Now it’s time to discuss the different construction accounting methods you may choose to support accurate financial tracking and reporting.

Cash Basis

The cash basis method is the easiest and simplest accounting method that construction companies can use.

This method involves recording revenue only once money is in the bank and recording the cost of goods sold and overhead costs when expenses are actually paid.

It’s important to recognize that while the cash basis method has some benefits, such as being easier to do and understand and shows cash flows, it also has some disadvantages that can lead to a misleading depiction of your financial health. For example, your project incurs one large expense in month 1 (say, materials for the job); and while you use that material over the course of six months, the expense is tracked in month 1. Meaning, profitability for month 1, relative to month 2-6 may be “misrepresented”.

Although many small businesses prefer the cash method for its simplicity, only some contractors qualify. Notably, those who do qualify generally yield lower taxes making it a desirable accounting option for tax purposes. In the U.S., businesses that make under $25 million annually can choose to use the cash basis method or the accrual method. Conversely, in Canada, the only businesses that can use the cash basis method are farmers and fishermen. All other businesses in Canada must use the accrual method for filing taxes.

Generally speaking, construction businesses that are a corporation, have partnerships, maintain inventory or exceed the threshold for cash basis method must choose one of the following accounting methods.

Accrual Method

Unlike the cash basis, where revenue and expenses are recorded when you receive, or give, money, the accrual method recognizes revenue when it’s earned and recognizes expenses when they are incurred. In accrual, the point in time in which cash is received or given, does not impact revenue/expense recognition.

And just like the cash basis method, accrual has its advantages and disadvantages. It’s generally accepted that accrual is more complex than cash basis, and so for businesses that need a more basic system, cash basis may be appropriate. However, when businesses want to produce a “clearer picture” of their profitability and financial position (to help with more effective decision making) the accrual system may provide more accuracy than the cash basis method.

This is beneficial for larger construction projects with complex financial structures, who want to understand their profitability.

Percentage of Completion Method

Next up is the percentage of completion method, which is considered one of the best accounting methods for construction projects. This method provides a more accurate way for accountants to track the expected gross profits and losses of each project. Contractors record income and expenses regularly throughout each project and revenue is only calculated for the portion of a project that has already been completed.

For a simple example, if your total estimated costs are $5M, and you’ve incurred $2.5M in costs, then your project is 50% complete. This means that you can now recognize 50% of your revenue. Say your contract is for $8M, you can now recognize $4M (aka, 50%).

This method gives contractors a better understanding of whether or not their projects will be profitable before the project is completed. Although this method is based on estimations, it generally provides accurate financial data that can be used to better manage profit margins.

The percentage of completion method is often ideal for long-term contracts because tax calculations are made each year. This approach reduces your tax burden at the end of the project and protects you from the risk of tax fluctuations. On the other hand, if you prefer to defer your taxes, the next method may be a better option for you.

Completed Contract Method

The completed contract method involves reporting expenses and income only once a contract is completed in full, although payments may be sent or received throughout the duration of a project.

Contractors may use the completed contract method if they assess unpredictability around being paid, if it’s not possible to calculate the percentage of completion for a project, or if they prefer deferring their taxes. By using this method, contractors can defer taxes until a project is completed.

Keep in mind that using this method could increase your tax burden in the long run if tax laws are amended. Proceed with caution when using this method!

What Accounting Standards are Used in the Construction Industry?

With large sums of money and many stakeholders invested in the service and construction industry, businesses are expected to adhere to accounting standards and regulations. Failing to meet these standards can lead to trust issues with clients and stakeholders, tax implications, and fines or legal action.

Let’s explore some of the primary accounting standards used in the North American industry.

Generally Accepted Accounting Principles (GAAP)

GAAP, issued by Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB), is a common set of accounting standards and practices designed to ensure consistency, clarity, and comparability in the financial statements of U.S. and Canadian companies.

GAAP covers revenue recognition, contract costs, and financial reporting in construction. The percentage-of-completion method is commonly used under GAAP for long-term construction contracts, allowing revenue and expenses to be recognized as the work is performed. The accrual method aligns with GAAP and the completed contract method is also accepted by GAAP under certain conditions.

International Financial Reporting Standards (IFRS)

IFRS is a set of global accounting standards developed by the International Accounting Standards Board (IASB). It aims to make international financial reporting transparent, comparable, and consistent. In Canada, publicly traded companies and certain other entities are required to use IFRS for their financial reporting.

IFRS 15 – Revenue from Contracts with Customers is particularly relevant for the construction industry. It establishes a comprehensive framework for determining the timing and amount of revenue to be recognized. IFRS 15 uses a five-step model to guide companies on revenue recognition from contracts with customers, applicable to various construction contracts.

Accounting Standards for Private Enterprises (ASPE)

While GAAP and IFRS share similarities in their approach to revenue recognition and financial reporting, ASPE is tailored to the specific context of private enterprises in Canada, offering a more streamlined set of standards. Developed by the Canadian Accounting Standards Board (AcSB), ASPE is designed to meet the needs of private enterprises for clear and practical financial reporting.

ASPE is similar to GAAP in many respects but offers simplified reporting options and fewer disclosure requirements, making it more accessible for private companies, including those in the construction industry.

ASPE covers revenue recognition and measurement principles that are pertinent to construction accounting, focusing on the cost-recovery method for long-term contracts and providing guidance on how to account for contract costs and revenues.

How Do You Record Construction Accounting?

When it comes to recording construction accounting, service and construction businesses have a number of different options to record and track expenses and costs. The systems and methods used will depend on the size of your business, the complexity of projects, and the level of detail and efficiency required

Let’s explore how the choice of accounting system significantly impacts a construction company’s ability to track and report on business costs, maintain accounting and payroll standards, and ensure financial data integrity:

1. Journals

Journals are the most fundamental accounting tools, where transactions are recorded manually. Each entry details the date, accounts affected, and amounts debited or credited, providing a chronological record of all financial transactions.

Pros:

- Journals are simple to use and ideal for small-scale businesses with financially lean operations. They are easy to set up and require minimal accounting knowledge.

- They are a low-cost investment, requiring a simple ledger book or basic digital document.

Cons:

- Manually recording accounts in journals is time-consuming and error-prone.

- Journals do not produce accurate cost, financial and WIP reporting, which is required in assessing profitability, cost overruns, financial health and forecasting.

- If a company wishes to scale their operations and requires multi-company accounting features, journals will be ineffective in supporting data accuracy and efficiency for the accounting staff.

2. Spreadsheets

Spreadsheets like Microsoft Excel offer a more efficient way to record accounting with some automation compared to journals. They help with categorizing data, performing calculations, and generating simple reports with simple formulas.

Pros:

- Spreadsheets are often available at a low cost through Microsoft Office or Google Docs.

- Many people are already familiar with working on spreadsheets and there are many resources available online to help accounting and payroll staff create desired formulas and functionalities.

- With some time invested into setting up formulas and macros for advanced calculations, a bookkeeper can generate financial reports, as well as tabulate and compare data.

Cons:

- While formulas can automate some calculations, there is still a considerable amount of manual work required by the accounting back office staff. This is particularly evident with duplicate data entry, which is prone to human error and requires extra time spent to verify data.

- Spreadsheets can become difficult to manage when there are multiple users accessing the spreadsheet, whether it may be for viewing or data entry. This could lead to potential version control issues, affecting the data integrity.

3. General Accounting Software

Standard accounting software is designed to manage financial transactions and operations within businesses and organizations. It automates and streamlines accounting tasks, including but not limited to recording transactions, managing accounts payable and receivable, tracking expenses and revenues, processing payroll, and generating financial statements.

Pros:

- Accounting systems offer efficiency and accuracy by automating many accounting processes, and reducing the time spent on data entry and calculations.

- They offer a range of reporting features for better financial visibility and decision-making.

- There are some affordable accounting software options for small to mid-size construction companies, which help streamline accounting processes and will integrate with other third-party construction software.

Cons:

- Standard accounting software may not cater to the specific needs of the construction industry, such as payroll processing, job costing, invoicing & billing, project management, and tax preparation.

- While it’s more affordable than specialized construction accounting software, it still requires a considerable amount of money and time to adapt it into a business’ existing operations.

- If a business doesn’t have an effective way to connect their accounting software with data from the field in real-time (through third-party software), they may not have an accurate representation of their business’ costs and profitability.

- Operating accounting software integrated with third-party software may be risky and costly, as it can still require some manual intervention, affecting the timeliness and accuracy of your financial data and reporting.

4. Construction Accounting Software

Unlike general accounting software which caters to a broad range of industries with standard accounting functions, construction accounting software is tailored specifically to address the unique accounting needs of the construction industry, including job costing, progress billing, change order management, and more.

Pros:

- It has features and functionalities designed to address the needs of the construction industry.

- Construction accounting software integrated in real-time with the field produces more accurate, timely data on costs, which leads to better insights to improve profitability and cash flow.

- Some construction accounting software providers offer multi-company accounting functionality, which is an excellent feature for businesses who already manage multiple companies or for those planning to scale their business.

Cons:

-

The initial investment of time and money to implement construction accounting software may be higher than general accounting software.

- Implementation and training may require more time due to construction accounting software being a more comprehensive solution with specific features for the industry.

If you’re interested in learning a step-by-step approach on how to record construction accounting, you can check out this blog.

What Accounting Software Should Construction Companies Use?

When choosing the best accounting software for a service and construction business, one should assess the goals and concerns of the business and how their back office team and accounting software can support these goals and concerns.

To begin, construction business owners and accounting professionals should ask if they trust their accounting solution to produce accurate, timely cost and accounting data. If the answer is unclear and data integrity is important for your business, then it may be time to consider an alternative solution.

Here are some features that should be considered when selecting construction accounting software:

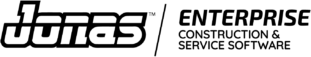

Accurate Reporting

Accurate reporting is the backbone of informed decision-making. Construction accounting software should offer comprehensive reporting tools that provide accurate insights into financial health, project performance, and operational efficiency. This enables businesses to build trust when analyzing profit fade, cash flow, trends, provide better estimates, and make data-driven decisions that drive growth and profitability.

Job Costing

Job costing is critical for tracking the financial progress of construction projects. Construction accounting software should facilitate detailed job costing that can automatically allocate expenses by project, task, and material, allowing project managers to see exactly where money is being spent. This feature helps in identifying cost overruns early, ensuring that projects stay within budget and maintain profitability.

Invoicing & Payments

Efficient invoicing and payments processing is essential for maintaining cash flow and customer relationships. Construction accounting software should streamline the creation of accurate invoices, automate billing cycles, and facilitate quick payment processing. This not only improves cash flow but also reduces administrative burden and enhances client satisfaction by providing clear, timely billing communications.

Real-Time Cost Tracking

Real-time cost tracking allows construction businesses to monitor expenses as they occur, providing immediate visibility into the financial status of projects. Construction accounting software with this feature helps managers make proactive adjustments to keep projects on track and within budget, reducing the risk of cost overruns and enhancing project profitability.

Cash Flow Management

Effective cash flow management is crucial for the survival and growth of any construction business. Construction accounting software should provide tools for forecasting, tracking, and managing cash flow, enabling businesses to plan for future expenses, manage payments to suppliers and subcontractors efficiently, and ensure that there is always sufficient cash on hand to cover operational needs.

Compliance

The construction industry is subject to a number of regulations and standards. Construction accounting software should help businesses maintain compliance with tax laws, labor regulations, safety standards, and financial reporting requirements. By automating compliance-related tasks and keeping accurate records, the software can help minimize the risk of legal issues and penalties.

Integration with the Field

Seamless integration between the back office and field operations is key to the success of any service and construction business. Construction accounting software should offer mobile access and integration with field data to allow for real-time information exchange between project managers, field staff, and the accounting department. This helps ensure that financial decisions are based on the latest operational data.

Multi-Company Accounting

For construction businesses that operate multiple entities or divisions, multi-company accounting functionality is a necessity. Construction accounting software should support consolidated financial management across all areas of the business, enabling centralized control while allowing for customized reporting and compliance at the individual entity level. This feature simplifies financial management and provides a comprehensive view of the company’s financial health.

Streamline Your Accounting Processes with Integrated Construction Accounting Software

Accounting for construction companies demands detailed accounting methods to accurately reflect the unique nature of the service and construction industry. Service and construction businesses perform short-term work where fulfilling maintenance agreements and emergency work orders generate cash in high-paced intervals. However, they also work on long-term jobs where the scope of work, costs and revenue may change throughout the project. As a result, job cost tracking and contract management is crucial, which some general accounting software solutions may not be able to offer.

Therefore, businesses that wish to maintain their financial data accuracy and integrity should consider integrated construction accounting software –software that can unify their field and back office operations together in real-time. When cost and revenue data flow directly from the field to the back office, contractors can stay apprised of their latest cost and financial updates and produce accurate, timely reporting in order to make effective decisions.

If you’re interested in learning more about Jonas Construction Software’s integrated construction accounting solution, let’s chat!