Last Updated on November 11, 2024

In today’s fast-paced construction industry, effective cost management is essential to protect profits and ensure project success. Rising material costs, labor shortages, and unpredictable project delays often result in costly overruns, putting project profitability at risk. In fact, global construction projects are facing significant cost and delivery overruns, with claims exceeding $91 billion and cumulative overruns amounting to 876 years.

How can contractors consistently stay on top of costs while managing complex projects and service contracts?

The key lies in optimizing the job costing process for accurate and real-time visibility into project expenses. This allows contractors to make informed decisions, allocate resources more efficiently, and maintain strong cost control. By going beyond tracking costs, job costing provides a detailed breakdown of different cost elements and allocates them to the appropriate cost types, project phases, and GL accounts. This helps monitor every dollar spent, identify inefficiencies, and uncover cost-saving opportunities, ultimately improving project profitability.

In this blog, we’ll explore the essential components of construction job costing, guide you through the steps to implement an accurate job costing system and explore how integrated construction solutions can enhance your job costing.

- What is Job Costing in Construction?

- How to Implement Accurate Job Costing in Construction

- How to Improve Construction Job Costing with Technology

- Benefits of Job Costing Software

- Get More Accurate Job Costs with Jonas Construction Software

What is Job Costing in Construction?

Job costing is a fundamental construction accounting method for tracking, managing, and analyzing all the costs associated with a specific project. It allows businesses to determine project profitability, manage resources effectively, and make informed decisions about future projects. By breaking down project expenses into cost items, job costing enables contractors to know exactly where money is being spent, spot cost overruns, and adjust expenses or budgets as needed.

Job costing offers a detailed, micro-level analysis of profit and loss for individual projects. By allocating costs not just to the General Ledger (GL), but also to specific projects, phases, and cost types, job costing gives contractors better control over project expenses and minimizes the risk of profit fade.

In construction, no two projects are the same, and costs can vary significantly. To manage these costs effectively, job costing groups project expenses into key categories, allowing contractors to track and control spending more precisely. The main categories of job costs include:

Direct Costs

Direct costs in construction are expenses directly associated with a specific project, including raw materials, labor (wages and salaries), equipment costs such as machinery rental or depreciation, and subcontractor fees for specialized services like electrical, plumbing, or HVAC work.

Indirect Costs (Overhead)

Indirect costs in construction are expenses that support the overall business operations and are not directly linked to a specific project. Examples include administrative expenses, office rent, legal fees, and utilities for on-site facilities.

Contingency Reserves

Contingency reserves are funds set aside to cover unexpected costs or risks that may arise during a project. These could include unforeseen site conditions, changes in material prices, or weather-related delays.

Other Miscellaneous Costs

These are additional necessary expenses for project completion, such as permits, inspections to ensure compliance with building codes, and temporary facilities like on-site offices or storage units.

How to Optimize Job Costing Accuracy in Construction

Without reliable cost data, contractors face the risk of budget overruns, resource misallocation, and project delays—all of which can erode profits. To help you avoid these costly setbacks, here are some practical tips for implementing a more accurate job costing system:

Identify Project Specifics

An accurate job costing system starts with a clear understanding of project specifics, including the scope of work, objectives, timeline, and required resources. Unclear project details often lead to inaccurate estimates, leading to wasted resources and cost overruns. By defining these specifics early on, contractors can track costs more accurately and minimize the risk of unexpected expenses.

Estimate Project Costs Accurately

Accurate cost estimates are crucial for establishing a reliable job costing system that allows contractors to track actual expenses against the budget, and allocate resources efficiently. Inaccurate cost estimates, such as underestimating materials, missing equipment depreciation, or overlooking indirect costs like utilities, can lead to cost overruns and project delays.

Engaging subcontractors early allows for precise quotes on specialized tasks like plumbing or electrical work contributes to more accurate cost estimates. Additionally, leveraging historical data from similar projects helps identify trends in labor, materials, and overhead costs, making it easier to anticipate cost fluctuations.

Regularly updating estimates throughout the project, to reflect changes in material prices, labor rates, or market conditions, ensures that the financial plan stays aligned with actual expenses and reduces the risk of budget overruns.

Optimize Cost Coding Systems

A well-structured cost coding system categorizes expenses by assigning specific codes to each cost element. By systematically organizing costs, contractors can track every dollar precisely, ensuring all expenses are captured and monitored against the project budget.

To further optimize the cost coding system for better accuracy, consider implementing multiple levels of tracking that assign codes to job, phase, and cost type levels. This enables contractors to break down costs into smaller components, making it easier to identify and address variances between planned and actual spending before they escalate. Standardizing cost codes across all projects ensures consistency, improving cross-project comparisons and analysis.

It is also important that all team members understand and apply these codes correctly. Field staff should input the correct data, project managers must use the right cost codes to track progress, and accounting must categorize these costs properly for financial reporting. Regularly reviewing and updating cost codes based on current project requirements and market conditions will keep the data relevant and actionable.

Integrate Job Cost Data with the General Ledger

After assigning costs to specific codes, the next step is to link job cost data to the general ledger (GL). This is crucial for ensuring that project expenses are accurately reflected in the company’s financial records, maintaining consistency between the job costing sub-ledger and the cost of goods sold (COGS) in the income statement.

When this integration occurs in real time, accounting and project managers have immediate access to up-to-date financial information. A job costing solution that integrates field data with the back office ensures that data—such as labor, materials, and equipment—is automatically linked to the correct GL accounts. This not only reduces manual errors but also improves overall accuracy in financial reporting.

Track Costs Effectively

One of the biggest challenges in achieving accurate job costing is the risk of inaccurate and delayed cost data from the field. To address this, businesses should consider replacing inefficient manual processes with digital cost-tracking solutions to ensure accurate and timely field data is captured. Digital tools such as daily logs, time-tracking, and field service management allow field staff to share critical project information—such as labor hours, job details, equipment usage, materials, change orders, and work orders— directly via mobile devices, reducing the risk of delays or errors in capturing project costs.

While these tools are available as standalone solutions, modern integrated construction management solutions connect these field tools with job costing, accounting, and reporting solutions. This integration ensures that accurate, real-time data is accurately reflected in the cost reports, helping project managers control budgets effectively, avoid cost overruns, and maintain the accuracy of job cost reports.

Manage Commitments

Understanding and managing financial commitments—such as purchase orders or subcontractor agreements—is essential for accurate job costing but often overlooked. Tracking these costs that have been agreed upon but not yet incurred ensures that your job costing system accurately reflects future expenses, helping you prevent budget overruns. By maintaining a clear view of commitments, contractors can manage cash flow more effectively and make informed decisions on resource allocation.

Leverage Cost and WIP Reporting

Improving the accuracy of job cost data is critical because it means cost and work in progress (WIP) reporting is also more accurate and reliable when it comes to providing a clear snapshot of the project’s financial state. To enhance the effectiveness of your cost and WIP reporting, ensure your reporting tools integrate smoothly with job costing and accounting systems. This integration guarantees data consistency across platforms and ensures your reports are always based on up-to-date and accurate financial information.

Additionally, consider leveraging reporting tools with drill-down capabilities. These tools allow you to transition from high-level summaries to granular details, helping you quickly identify specific cost drivers and address potential issues before they escalate. Moreover, custom reporting capabilities enable you to track and focus on the most critical metrics for each project, ensuring you are always monitoring what matters most.

How to Improve Construction Job Costing with Software Technology

The key to improving job costing is having access to real-time, accurate financial data. Without up-to-date cost insights, contractors face difficulty staying on budget and protecting profit margins. Specialized job costing software addresses this challenge by automating the allocation of project expenses to specific job codes, ensuring that every dollar is accurately tracked and linked to the appropriate GL accounts. This real-time integration not only eliminates the need for manual cost tracking but also significantly reduces errors in assigning expenses, allowing contractors to maintain tighter control over their project finances.

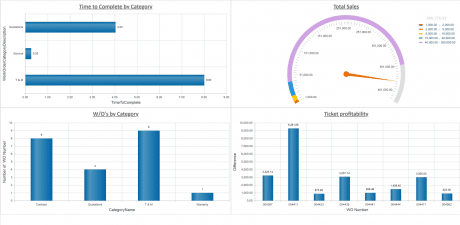

To further enhance job costing accuracy, many construction firms adopt integrated construction accounting software, which links job costing to core accounting functions such like payroll, billing, and financial reporting. This integration provides an accurate financial overview of all projects, optimizes payroll processing, and minimizes billing errors and delays. Additionally, construction reporting powered by real-time job cost data allows businesses to monitor project KPIs, mitigate risks, and maximize profitability.

Construction management solutions (CMS) integrate job costing, accounting, project and service management, and reporting functionalities into a single comprehensive platform. This integration synchronizes field operations with back-office processes, giving contractors full cost control through real-time data access. With all project information centralized in one system, businesses gain greater visibility into project costs, reduce inefficiencies, and improve overall profitability.

Benefits of Job Costing Software

While job costing software on its own is useful in managing project costs, its true potential is realized when integrated into a comprehensive construction management solution. Here are the key benefits offered by an integrated job costing system :

- Improve Price Setting Based on Historical Data

Integrated job costing solutions store historical data from past projects, which can be analyzed to set more accurate prices for future projects. By reviewing actual costs, contractors can better understand the expenses associated with different project components, making it easier to create more precise and competitive bids. Access to detailed historical data also helps in correctly estimating the resources required for similar future projects, leading to more informed decisions on budget allocation.

- Accurate Client Billing

Accurate billing is essential to maintain healthy cash flow and sustain long-term client relationships. Yet, client billings can be inaccurate when expenses aren’t being fully captured or not attributed to the right projects. This can result in underbilling, missed reimbursements, and disputes with clients.

Integrated job costing software addresses these issues by capturing all project-related expenses in real-time, including labor, materials, equipment, and overhead. This comprehensive tracking ensures that all billable expenses are captured and allocated properly, resulting in more accurate and transparent client billing. For contractors managing diverse projects with varying billing structures, construction management software with advanced job costing can support specialized billing processes such as Progress Billing, AIA Billing, T&M Billing, and Unit Price Billing, enabling them to handle complex billing requirements efficiently.

- Reduce Workflow Inefficiencies

Integrated construction management solutions are designed to streamline project workflows, and when integrated with job costing, they automate many of the manual processes involved in cost tracking, cost allocation, and report generation. This automation reduces the need for duplicate data entry and minimizes errors while improving the accuracy and integrity of financial data.

With construction management software, all project-related data—such as costs, schedules, and resources—flow seamlessly between the field and the back office, ensuring that cost data is up-to-date and accurate. By automating these processes, contractors can shift focus from manual administrative tasks to more strategic, value-driven activities. This not only saves time but also enables project teams to quickly address cost inefficiencies.

- Track Profit Margin on Every Job

One of the most significant advantages of using integrated job costing software is its ability to track profit margins per job. By monitoring job costs in real-time and comparing them against the budget, project managers can quickly identify which projects are meeting, exceeding, or falling short of profitability targets. This level of visibility enables more informed decision-making, allowing businesses to adjust strategies as needed to enhance profitability.

Get More Accurate Job Costs with Jonas Construction Software

Jonas’ job costing solution, powered by integrated construction accounting software, provides service and construction businesses with real-time cost and financial insights to help streamline job costing and better manage project costs. By automating accounting, streamlining workflows, and delivering accurate construction WIP and cost reporting, Jonas helps to increase operational efficiency, make informed and timely decisions, and protect profits.

Our fully integrated construction solution combines accounting, payroll, project management, service management, and reporting functionalities into one cohesive platform. This seamless integration unifies field operations with back-office systems, ensuring that cost data entered in the field is automatically linked to the appropriate phases and cost categories in the back office. This real-time visibility into costs and financials helps you stay on budget, manage expenses effectively, and protect your profits.

Discover how Jonas can help you manage cost overruns, improve cash flow predictability, and boost profitability across your projects and services. Request a demo today!